Investment of Influence? The UAE's Complicated Impact on Africa's Sustainable Future

- Alizée Nasr

- Nov 28, 2024

- 6 min read

Written by Alizée Nasr (BSc Management)

Muse Bihi Abdi, president of Somaliland, and Sultan Ahmed bin Sulayem, CEO of DP World, at the signing ceremony of the Berbera port expansion project in Hargeisa in 2018 © Tiksa Negeri/Reuters

In May this year, something remarkable happened: UAE President Sheikh Mohammed bin Zayed al-Nahyan and his entourage celebrated Eid in South Africa's Eastern Cape province. Far from being a routine festive occasion, this event symbolized the UAE's growing presence and ambition in Africa. This gathering underscores a broader narrative explored in this article: the UAE's deepening relationship with Africa, spanning commercial, strategic, and financial dimensions. As global powers like China recalibrate their engagement on the continent, the UAE has stepped in, pledging $97 billion in investments over the past two years alone. This is an aggressive move that redefines its role in Africa's development and global competition for influence. By examining these partnerships, we uncover how this engagement is reshaping Africa's trajectory while reflecting the UAE's long-term strategic vision.

In this article, we'll dive into the UAE's deepening partnership with Africa, breaking it into three key dimensions: commercial, strategic, and financial. This isn't just a matter of money flowing across borders; it's about a long-term vision. The UAE isn't merely looking to make investments but to cement relationships, harness opportunities, and position itself as a key player in Africa's growth story. Emirati companies are entering sectors where others hesitate: renewable energy, mining, agriculture, and communications. They're placing bets on Africa's potential, taking on risks many traditional investors shy away from.

We'll also take a step back to consider the bigger picture. Africa's rising role on the world stage and the UAE's bold ambitions create a fascinating dynamic. This future-facing strategy speaks to economic promise and regional stability. Through this journey, we'll explore the layers of this relationship, unveiling how these two regions are shaping each other's futures in ways the world may not yet fully understand.

Beyond Oil: UAE’s Bold Commercial Commitments in Africa

The UAE's commercial ventures in Africa are ambitious, yet they present many opportunities and questions about impact. Masdar, Abu Dhabi's clean energy giant, leads the charge in renewables with wind farms, solar projects, and battery systems across the continent. These $10 billion investments signal a commitment to Africa's energy future and reflect the UAE's green aspirations. Yet, as Masdar becomes a prominent player in Africa's power landscape, will this lead to affordable, accessible energy for local communities, or will it primarily enhance the UAE's international standing in renewable energy? The answer likely depends on how projects are structured, whether they prioritize local energy needs, and the balance between profit-driven motives and genuine development goals.

This complex balance of mutual benefit and self-interest is evident in the UAE's fossil fuel investments. Abu Dhabi National Oil Company's acquisition of a stake in Mozambique's Rovuma gas basin acknowledges Africa's need for traditional energy sources while keeping the UAE invested in oil and gas. As African countries aim to expand their energy access, the question arises: does this reliance on fossil fuels align with Africa's sustainable future, or does it prolong dependence on an industry the UAE itself is gradually moving away from? While fossil fuel investments may address immediate energy shortages, they risk delaying Africa's transition to cleaner energy solutions, a path the UAE itself has acknowledged as essential for long-term sustainability. This highlights a broader challenge: whether Africa can leverage such investments as a steppingstone toward renewable energy or if it will become entrenched in an outdated energy paradigm shaped by external interests.

In mining, the UAE's approach reflects bold ambition and control over critical resources. International Resources Holding's $1.1 billion purchase of Zambia's Mopani copper mine and Primera's 25-year monopoly on artisanal gold in the Democratic Republic of Congo highlight how UAE companies are securing Africa's resource wealth. This assertive presence raises more profound questions about local values. Will these ventures lead to job creation, infrastructure improvements, and sustainable practices, or will they primarily funnel resources to Dubai, where much of Africa's gold already flows? While such investments hold the potential to stimulate local economies and infrastructure, they also risk perpetuating a pattern where African resources are extracted with limited benefits for local populations. The key question is whether African governments and communities can negotiate terms that ensure fair value and sustainability, or if these deals will predominantly serve external interests, reinforcing historical dynamics of resource exploitation.

Through these high-stakes investments in renewables, fossil fuels, and mining, the UAE positions itself as a strategic partner in Africa's growth. Yet, each venture carries different implications for African nations' autonomy, economic resilience, and sustainable progress.

The New Silk Road? UAE’s Port Investments and Power Plays in Africa

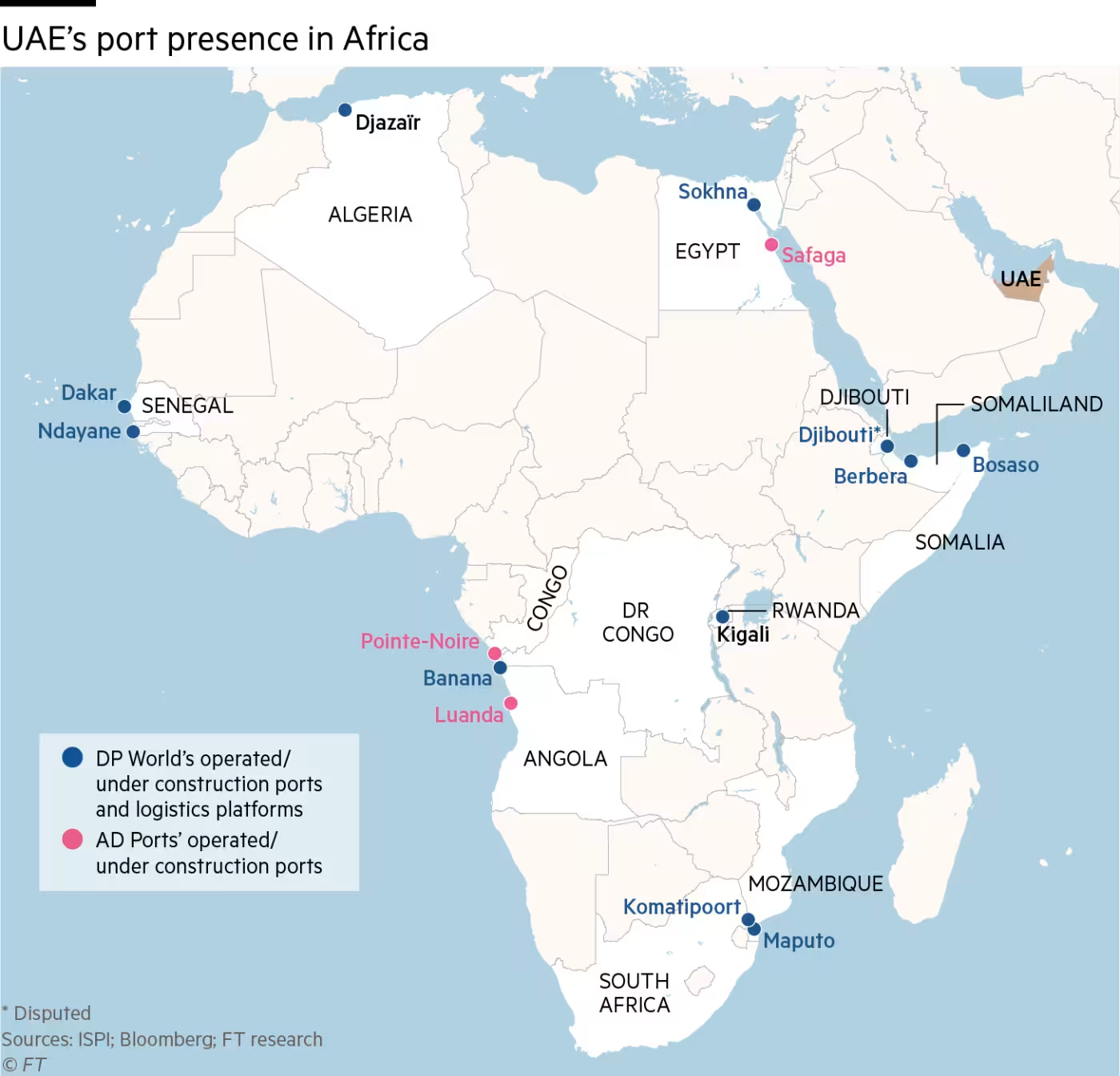

The UAE's strategic ventures across Africa reflect a calculated expansion of influence, mainly through critical infrastructure and defense footholds, that parallels China's Belt and Road Initiative in many ways. Central to this approach is DP World, a global logistics and port management company, which has invested over $3 billion into African ports, creating a network that stretches from Mozambique on the Indian Ocean to Algeria on the Mediterranean and Angola on the Atlantic (as seen in Map 1). Like China's efforts to secure key trade routes and supply chains, DP World's network nearly encircles the continent, positioning the UAE as a vital conduit between Africa and global markets.

Nowhere is the UAE's intent more apparent than in Berbera, Somaliland, a port on the Gulf of Aden. In this geopolitically strategic location, DP World has invested $300 million to develop the port and free-trade zone, while the UAE has upgraded the coastal city's airport. UAE flags flutter in this remote desert, marking a foothold along one of the world's busiest maritime routes. With a 25-year concession for a naval base, the UAE's influence in Berbera extends beyond commerce to security. Just as China has established similar dual- use infrastructure hubs along critical trade corridors, Map 2 illustrates China's extensive investments in sub-Saharan African ports as builders, operators, and funders. In a comparable fashion, the UAE is leveraging port investments to serve both commercial and defense interests.

However, unlike China's broader focus on economic influence, the UAE's footprint in Africa directly involves political and security matters more directly. This became evident in Libya, where reports suggest the UAE supported General Khalifa Haftar's 2019-2020 offensive to seize Tripoli from the UN-backed government. Although the UAE denies violating arms embargoes, its alleged backing of Haftar conveys a willingness to support aligned factions in Africa's political landscape. This is an approach China has typically avoided in favour of economic partnerships.

Together, these moves reveal the UAE's distinctive strategy: one that, like China's, seeks to reshape Africa's infrastructure and trade dynamics yet also underscores the UAE's unique emphasis on security and geopolitical influence. These actions convey how countries today, in a globally competitive environment, increasingly pursue influence through a blend of economic and strategic investments, seeking to secure financial returns and footholds in critical regions. The question remains: will this competition for influence benefit Africa's ambitions for development and stability, or will it serve external powers looking to expand their reach?

A Financial Gateway: Dubai’s Influence on African Investment and Wealth

Financially, the UAE—especially Dubai—has become a popular alternative to traditional hubs like London and Geneva for African companies and wealthy individuals. Western legal firms, investment banks, and wealth managers now offer their services in Dubai, appealing to clients from Africa and beyond who are attracted to its flexible, accommodating environment. Dubai’s appeal as a "safe harbor" for wealthy Africans, including politically exposed individuals, has only grown. A prominent example is Isabel dos Santos, the billionaire daughter of Angola's former president, who moved to Dubai in 2020 after the Angolan government froze her assets.

Yet, this financial haven comes with its share of controversy. While the US views the UAE as a vital ally in the Middle East, its financial role in Africa raises questions. As one former Biden administration official points out, the UAE's involvement in Africa is complex; it has a mix of constructive investment and destabilizing influence. The ambiguity surrounding Dubai's financial environment, welcoming to those who may be viewed as problematic elsewhere, underscores the UAE's unique, sometimes contentious position on the global stage.

The Bottom Line: Investment or Influence?

As the UAE deepens its economic, strategic, and financial involvement in Africa, the question remains: is this relationship fostering a sustainable future for Africa or creating a dependency primarily serving Emirati interests? The UAE's multi-faceted approach—from clean energy initiatives to a strategic network of ports and a flexible financial environment—suggests a long-term commitment to Africa's growth. Yet, an underlying ambiguity mirrors global competition for every promise of infrastructure and opportunity. As powers like China and the UAE establish footholds across the continent, Africa's leaders must weigh the benefits of foreign investment against the potential risks of external influence. Ultimately, Africa's future may depend on its ability to navigate these partnerships with its vision for progress and sovereignty at the forefront.

Comments